This summary expands upon Bakos and Treacy’s influential framework in their paper, “Information Technology and Corporate Strategy: A Research Perspective,” which explores how IT can impact competitive strategy and corporate advantage. The following sections break down the framework, explain competitive advantage, and illustrate how IT influences decision-making at various levels of asset specificity. This comprehensive approach also includes applications of the framework, comparisons with related theories, and real-world examples.

1. Understanding the IT Framework: Functionalities and Attributes

In Bakos and Treacy’s model, Information Technology (IT) is broken down into three functionalities:

- Storage: The capacity to hold and retrieve information.

- Processing: The ability to analyze and compute data for decision-making.

- Communication: The facilitation of information exchange across departments, firms, or systems.

Each functionality has three attributes:

- Capacity: The volume or quantity that can be handled.

- Quality: The effectiveness, accuracy, or reliability.

- Cost: The associated expenses of managing and maintaining the function.

Together, these nine dimensions (3 functionalities x 3 attributes) provide a comprehensive framework to assess and compare IT systems. For instance, a robust cloud storage system would score highly on storage capacity, while a real-time data analytics platform would prioritize processing quality.

Practical Examples

- Storage: A retail company might use cloud storage to store vast amounts of sales and customer data. The capacity of storage is crucial to support growing data.

- Processing: AI algorithms in healthcare require high processing quality to ensure accurate diagnostics.

- Communication: A multinational corporation relies on high-capacity, high-quality communication tools to facilitate coordination across global teams.

2. Defining Competitive Advantage: Efficiency and Bargaining Power

Competitive advantage, according to this framework, comprises two key components:

- Competitive Efficiency: The ability to operate at a lower cost or higher quality than competitors, often through process improvements or superior technology.

- Bargaining Power: The ability to control or influence customers, suppliers, or competitors. This is achieved when switching costs are high for customers or suppliers, effectively locking them into a relationship with the firm.

Bargaining Power in Detail

Bargaining power is essential to maintaining a competitive edge. It grows when customers face high switching costs—the costs associated with changing to a competitor’s product or service. High switching costs might be due to unique product features, proprietary technology, or contractual obligations that make switching expensive or difficult. For example:

- Software ecosystems (like Adobe’s Creative Suite) create high switching costs by integrating various tools that work seamlessly together, discouraging users from switching to alternatives.

- Telecommunication companies often lock customers into long-term contracts with cancellation fees, increasing switching costs.

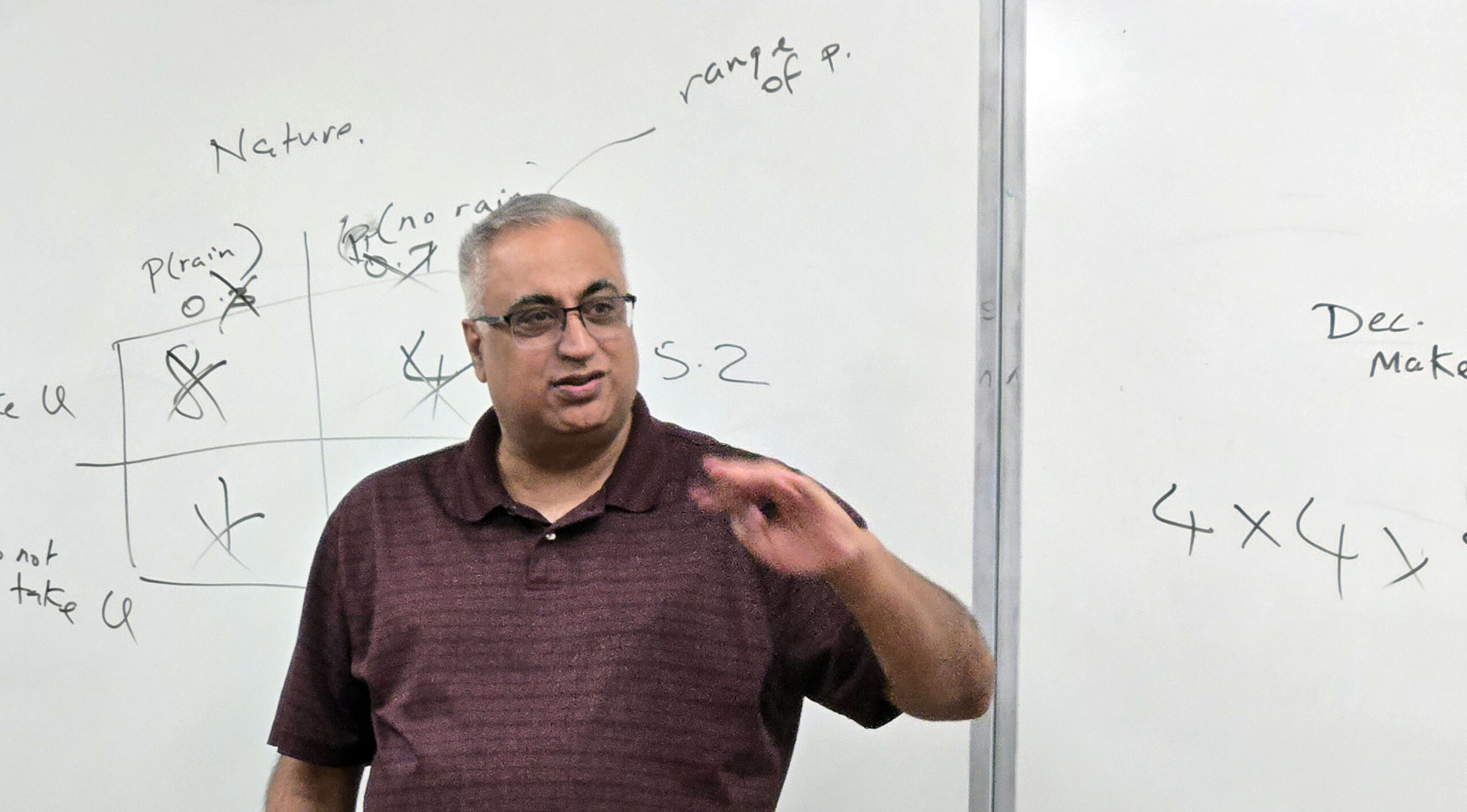

3. Asset Specificity and the Market vs. Hierarchy Decision

Asset Specificity is the degree to which an asset is tailored for a particular transaction or relationship. This concept significantly impacts both production costs and transaction costs and determines whether it’s more economical to use the market (outsourcing) or an internal hierarchy (in-house production).

- Low Asset Specificity: For generic products or services, the cost of the market is lower than the cost of hierarchy. For example, pencils, which are standardized, can be sourced from the market at a low cost due to economies of scale.

- High Asset Specificity: For customized or specialized products, transaction costs rise in the market due to contracting, coordination, and monitoring expenses. At a certain point, it becomes cheaper to produce in-house, as the cost of hierarchy may be lower than managing high transaction costs in the market.

The Efficient Boundary Between Market and Hierarchy

The framework suggests an “efficient boundary” where it becomes more cost-effective to move from market-based transactions to in-house production. When asset specificity is low, market mechanisms are generally cheaper. As specificity increases, however, the rising transaction costs may eventually make internal production (hierarchy) more cost-effective.

4. The Role of IT in Shifting the Efficient Boundary

Information Technology can play a transformative role in shifting this efficient boundary. By reducing transaction costs (such as coordination, contracting, and monitoring), IT can make it feasible to manage more specialized assets through the market rather than bringing them in-house. For instance:

- E-commerce platforms allow firms to outsource distribution and logistics to third-party providers by providing real-time tracking and integration.

- Blockchain technology reduces transaction costs by providing a secure, transparent ledger, which can be especially beneficial in high-asset-specificity transactions like supply chains for luxury goods.

In other words, as IT improves, firms can reduce coordination and monitoring costs, making the market a more viable option for managing high-specificity assets, which previously would have required internal management.

5. Practical Implications for Competitive Advantage: Applications to AI and Innovation

This framework is highly applicable for analyzing modern innovations like Artificial Intelligence (AI). The framework helps answer the question: does AI provide a competitive advantage? AI can offer competitive advantage if it:

- Enhances bargaining power by creating high switching costs (e.g., proprietary AI solutions that customers rely on).

- Increases competitive efficiency by enabling cost savings or quality improvements that competitors cannot easily match.

Example: In retail, AI-driven recommendation engines improve competitive efficiency by optimizing personalized suggestions, increasing customer satisfaction, and potentially raising switching costs as customers become accustomed to the tailored experience.

However, J. Barney, in a recent Harvard Business Review article, argues from a Resource-Based View (RBV) that AI may not inherently provide a sustainable advantage if competitors can easily replicate it. According to RBV, resources must be valuable, rare, inimitable, and non-substitutable (VRIN) to offer sustained competitive advantage. AI applications can be replicated or acquired by competitors, potentially eroding any advantage.

6. Related Theories and Frameworks

To strengthen understanding, it’s helpful to compare this framework with related theories:

- Porter’s Five Forces: While Porter’s model emphasizes industry structure and competitive dynamics (e.g., threat of new entrants, bargaining power of suppliers), Bakos and Treacy focus more on transaction costs and asset specificity within the firm, offering a more granular view of make-or-buy decisions.

- Resource-Based View (RBV): This view focuses on the unique internal resources of a firm, while Bakos and Treacy’s framework emphasizes how IT affects the boundary between market and hierarchy, providing flexibility for outsourcing.

- Transaction Cost Economics (TCE) by Oliver Williamson: TCE is foundational to understanding Bakos and Treacy’s argument about asset specificity. This framework builds upon Williamson’s ideas by integrating IT’s role in reducing transaction costs and shifting the efficient boundary.

7. Strategic Applications and Dissertation Potential

The Bakos and Treacy framework offers a structured way to approach dissertation topics on the role of IT in competitive advantage. Potential research questions include:

- Does AI provide sustainable competitive advantage through bargaining power and competitive efficiency?

- How do different types of IT (e.g., cloud computing, blockchain, AI) impact the market vs. hierarchy decision for asset-specific transactions?

Key Takeaways

- IT Framework: IT is understood through three functionalities (storage, processing, communication) and three attributes (capacity, quality, cost).

- Competitive Advantage: Defined through competitive efficiency and bargaining power.

- Market vs. Hierarchy: Asset specificity and transaction costs influence whether to outsource (market) or keep in-house (hierarchy).

- IT’s Role in Reducing Transaction Costs: IT can shift the efficient boundary, making it viable to outsource more asset-specific transactions.

- Applications to AI and Innovation: The framework provides a structured lens to assess the competitive advantage of emerging technologies.

- Theoretical Context: Connects to related theories like Porter’s Five Forces, RBV, and Transaction Cost Economics.

By internalizing this framework, students and professionals gain a nuanced perspective for analyzing how IT affects corporate strategy, decision-making, and competitive positioning, especially in the context of evolving technologies like AI and blockchain.

Leave a Reply