When describing a theory, it’s important to refer to Whetten’s framework, which focuses on the what, how, and why of a theory. This approach ensures that you cover the key constructs, the relationships between them, and the reasoning behind these relationships.

So, if you’re faced with a question in your comprehensive exams asking you to describe a theory, make sure to include:

- What: The constructs or main components of the theory.

- How: The relationships between these constructs.

- Why: The reasoning or rationale behind these relationships.

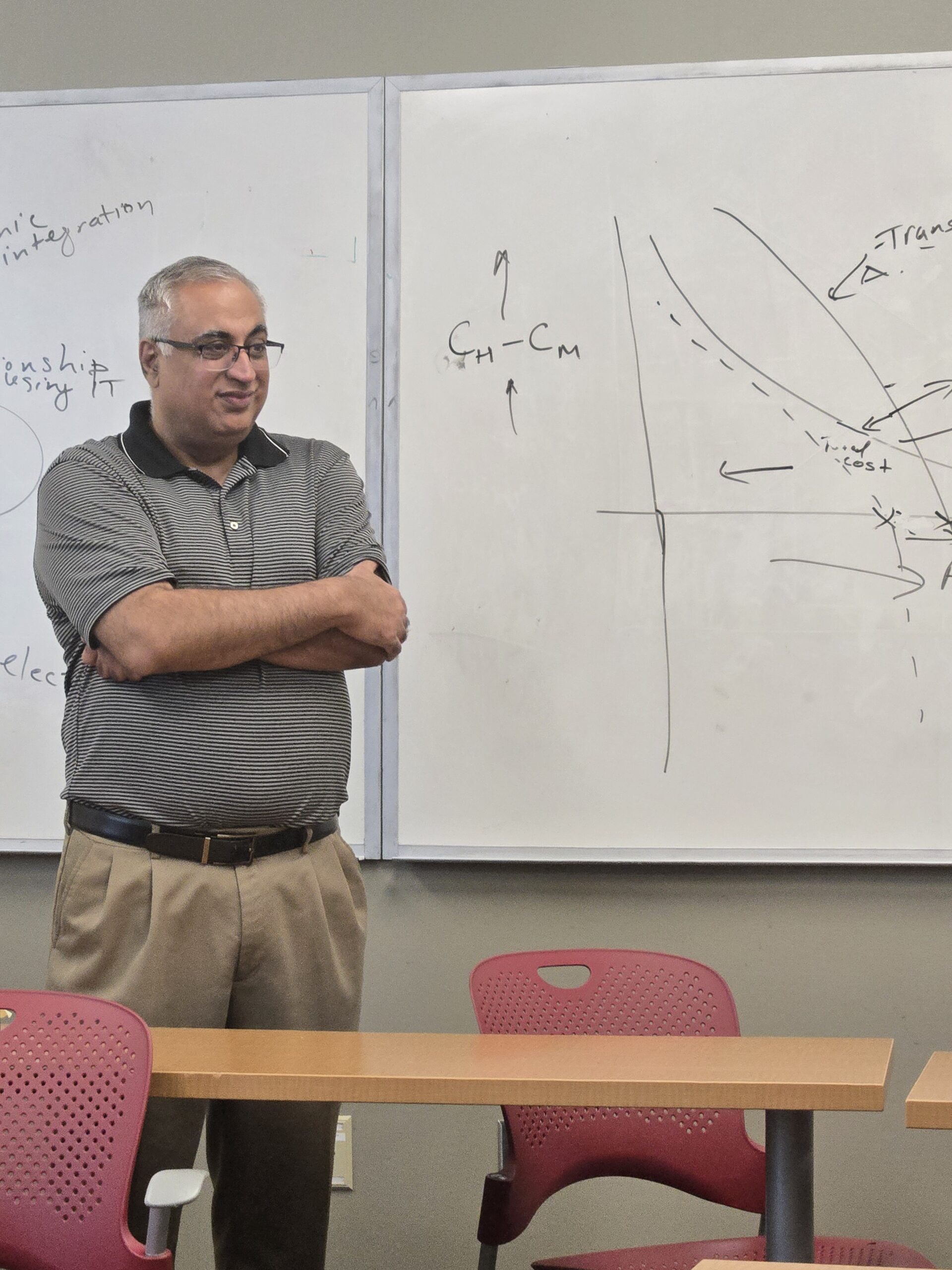

Applying the Framework to Transaction Cost Theory

What is Transaction Cost Theory?

Transaction Cost Theory examines how transactions (exchanges between two parties) should be governed to minimize costs and maximize efficiency. The basic unit of analysis is the transaction itself.

How Does the Theory Explain and Predict?

The essence of Transaction Cost Theory is determining the most efficient governance structure for transactions. The key points are:

- Market vs. Firm Governance:

- Market Governance: Transactions are coordinated through market mechanisms when transaction costs are low.

- Firm Governance: When transaction costs are high, relying on the market becomes inefficient, and it’s better to internalize transactions within a firm.

- Why Markets May Break Down:

- High Transaction Costs: When the costs associated with a transaction (such as negotiating, monitoring, and enforcing contracts) become extremely high, markets fail to function efficiently.

- Factors Increasing Transaction Costs:

- Asset Specificity: Investments are highly specialized and cannot be easily repurposed without significant loss of value.

- Complexity: Transactions are complex and cannot be fully specified in contracts due to uncertainty and unpredictability.

Why Do These Relationships Exist?

The theory is based on two fundamental assumptions about human behavior:

- Bounded Rationality:

- People have limited cognitive capabilities and cannot know everything about everything.

- This limitation means they can’t anticipate all possible future contingencies, making it impossible to draft complete contracts.

- Opportunism:

- Individuals may act in self-interest with guile, taking advantage of others when the opportunity arises.

- The potential for opportunistic behavior increases the need for safeguards like detailed contracts and enforcement mechanisms, which in turn raises transaction costs.

If people were fully rational and always honest, there would be no need for complex contracts or enforcement mechanisms. However, because of bounded rationality and opportunism, transaction costs exist and can become prohibitively high in certain situations.

Summary

Transaction Cost Theory is centered on how to govern exchanges between two parties efficiently. When transaction costs are low, market governance is sufficient. But when these costs become too high—due to factors like asset specificity and complexity—the market mechanism breaks down. In such cases, it’s more efficient to internalize the transactions within a firm to reduce costs and mitigate risks associated with bounded rationality and opportunism.

Leave a Reply