Fundamental Assumption of Agency Theory

Agency theory assumes that principals (such as shareholders or owners) and agents (like managers or employees) have inherently different goals. Principals generally seek to maximize profits and achieve high organizational performance, while agents may prioritize their interests, such as reducing effort or maximizing personal gain. This divergence in goals is known as the agency problem. If left unaddressed, it can lead to inefficiencies, as agents may shirk their responsibilities or make decisions that don’t align with the principal’s objectives, thereby lowering overall productivity and profitability.

Organizations as a “Nexus of Contracts”

Under agency theory, organizations are seen not as singular profit-driven entities but as a nexus of principal-agent contracts. Each relationship within the organization—whether between employees and managers, managers and executives, or executives and shareholders—is a unique contract where agents agree to act on behalf of principals. Organizational success, therefore, depends on how well these contracts align agent behavior with principal interests. When agents prioritize their own goals over the principal’s, it can lead to inefficiencies, wasted resources, and poor organizational performance.

The Principal-Agent Problem and its Variations

Agency problems can arise in numerous organizational relationships:

- Manager-Employee Relationships: Managers need employees to act in the best interest of the company, but employees may instead seek to minimize effort.

- Shareholder-CEO Relationships: Shareholders want to maximize stock value, while CEOs may focus on other goals, like expanding their influence or increasing departmental budgets.

Mechanisms to Address the Agency Problem

Contract Design in Agency Theory

Agency theory emphasizes designing optimal contracts to ensure agents act in the principal’s best interests. Contracts usually fall into two types:

- Behavioral Control: The principal monitors the agent’s behavior directly. Behavioral control can involve close supervision, frequent reporting, or extensive use of accounting systems to track activities. However, monitoring can be expensive and time-consuming, as it may require dedicated personnel or systems to ensure compliance.

- Outcome Control: Instead of monitoring behavior, the principal specifies desired outcomes or targets, rewarding agents based on goal achievement. This approach transfers some risk to the agent, who may face external factors (like market downturns) that impact performance. For example, a sales commission-based contract rewards the agent only if they meet certain sales targets, but the agent might find this unfavorable if external circumstances limit sales potential.

Types of Agency Costs

Agency theory outlines three main types of costs associated with aligning agent behavior to principal goals:

- Monitoring Costs: Incurred by the principal to supervise the agent’s actions, ensuring they are consistent with the principal’s goals. Examples include supervisory roles, regular performance reviews, and audit systems.

- Bonding Costs: Incurred by the agent to demonstrate accountability to the principal. For instance, an agent might submit regular reports or updates, or conduct end-of-day performance reviews. Bonding builds trust but also involves costs, such as the time and effort spent on documentation.

- Residual Loss: The unavoidable gap between the principal’s goals and the agent’s actions, even after monitoring and bonding efforts. For example, an employee might still take unauthorized breaks despite monitoring, resulting in some inefficiency that cannot be entirely eliminated.

Decision Information Costs and Organizational Structure

Decision Information Costs

These costs arise from the need to transfer relevant information to decision-makers within the organization. In centralized structures, information flows upward, incurring costs due to delays, potential for miscommunication, and the effort required to aggregate data from different parts of the organization. By contrast, decentralizing decision-making reduces information transfer costs but increases the need for monitoring to ensure alignment with organizational goals.

Centralization vs. Decentralization

The choice to centralize or decentralize decision-making is often based on comparing agency costs and decision information costs:

- High decision information costs may favor decentralization since it’s cheaper to let employees make decisions locally rather than relay information upward.

- High agency costs may favor centralization, as it’s easier for principals to maintain control and ensure alignment without additional monitoring at lower levels.

Transaction Cost Economics: Understanding Coordination Costs

External Coordination Costs and Vertical Integration

In transaction cost economics, external coordination costs arise when dealing with external suppliers or partners. Vertical integration reduces these costs by bringing outsourced functions within the firm, lowering the need for complex contracts and quality assurance measures that would be necessary with third parties.

- Vertical Integration: As firms incorporate more functions internally, they decrease external transaction costs but increase internal coordination costs, including the need for increased oversight and cross-departmental communication.

Production Costs in Markets vs. Hierarchies

Production costs differ depending on whether they occur in a market or hierarchy:

- Hierarchies generally face higher production costs due to the overhead associated with internal operations and the complexity of managing multiple activities.

- Markets benefit from specialized suppliers who can achieve economies of scale by focusing on a specific activity, thereby reducing costs per unit of production.

IT’s Role in Shaping Firm Size and Structure

The Dual Effect of IT on Firm Size

IT has the potential to transform organizational structure by influencing both external and internal coordination costs:

- Reduction in External Coordination Costs: IT enables firms to interact with external partners efficiently, lowering transaction costs and encouraging firms to remain smaller by outsourcing certain functions.

- Reduction in Internal Coordination Costs: IT also facilitates better internal communication and performance monitoring, allowing larger firms to manage complex structures more effectively.

Determining Optimal Firm Size

The impact of IT on firm size is context-dependent:

- If IT primarily reduces external coordination costs, firms may lean toward smaller structures and rely more on outsourcing.

- If IT primarily reduces internal coordination costs, firms may grow larger, as they can manage more functions efficiently within the organization.

Horizontal vs. Vertical Growth in Organizations

Vertical vs. Horizontal Expansion

- Vertical Growth: Involves integrating more stages of the value chain internally, increasing internal coordination and production costs due to managing additional in-house functions.

- Horizontal Growth: Expands the firm’s reach across multiple markets or customer segments, often reducing per-unit production costs through economies of scale and improving operational efficiency.

Costs of Horizontal Expansion

While horizontal growth may lower per-unit production costs, it has mixed effects on external coordination costs. For instance, expanding into new markets may require additional suppliers, raising coordination costs, or it may allow consolidation of suppliers, reducing coordination costs.

1. Expanded Background on Agency Theory and Transaction Cost Economics

- Historical Context and Evolution: Briefly tracing the origins of agency theory and transaction cost economics, including key contributions from scholars like Jensen and Meckling, Alchian and Demsetz, and Coase. This can help situate the reader in the foundational debates and progression of these theories.

- Comparison with Alternative Theories: Including contrasts with other organizational theories, such as stakeholder theory or resource-based views, would add context, showing how agency theory and transaction cost economics focus on specific organizational dynamics.

2. Detailed Case Studies

- Real-World Examples: Incorporating case studies of firms that effectively used IT to influence their vertical and horizontal structures can ground the theory in real-world examples. For instance:

- Benetton for horizontal expansion using IT to manage a vast, decentralized network of stores.

- IBM and Ford for examples of vertical integration and how IT helped manage complex hierarchies.

- Comparative Analysis: Cases of firms that chose different organizational paths (e.g., outsourcing versus vertical integration) due to IT capabilities, exploring successes and failures. This can illustrate the cost-benefit analysis behind choosing between centralization and decentralization.

3. Incorporating New IT Trends and Technologies

- Impact of Emerging Technologies: Discussing recent developments like cloud computing, artificial intelligence (AI), blockchain, and big data analytics. These technologies influence both external and internal coordination costs, making it easier for firms to decentralize or manage large, dispersed teams.

- Network Effects and Platform Models: Including how digital platforms (e.g., Uber, Airbnb) have enabled firms to minimize asset ownership while scaling rapidly across markets. This new model of “platform firms” changes the dynamics of horizontal and vertical integration and could serve as a counterpoint to traditional firm structures.

4. Analyzing Firm Size and Structure with Modern Data

- Quantitative Insights: Leveraging empirical data on firm size trends across industries can add quantitative rigor. This might involve reviewing datasets on how digital transformation has influenced firm sizes and structures over recent years.

- Industry-Specific Trends: Exploring how IT impacts vary by industry, such as manufacturing versus service industries, and discussing industry-specific tendencies toward vertical or horizontal integration.

5. Limitations of Agency Theory and Transaction Cost Economics

- Behavioral Economics Perspective: Introducing limitations from behavioral economics, which questions some of the rational assumptions in agency theory, such as agents always acting out of self-interest. Discussing concepts like bounded rationality, cognitive biases, and trust-based relationships can provide a fuller picture.

- Transaction Cost Boundaries: While transaction cost economics explains many firm behaviors, it may not account fully for complexities in hybrid organizational forms or new network-based organizational structures (e.g., decentralized autonomous organizations in blockchain technology).

6. Future Directions and Implications

- Implications for Organizational Design: Adding a section on how organizations might optimize their structure based on this theory, especially in fast-evolving sectors, could provide actionable insights for practitioners.

- Policy Implications: Considering the role of regulations, especially in industries heavily influenced by IT, such as data privacy, cybersecurity, and labor laws. This could include how policies impact transaction costs and, consequently, firm size and integration decisions.

- Future Research Directions: Suggesting areas for future research, such as the impacts of remote work and gig economy models on internal and external coordination costs, or the role of environmental factors in shaping firm structure (e.g., sustainability requirements).

7. Framework or Model for Decision-Making

- Decision-Making Model: Developing a practical model or decision framework that helps managers decide between centralization and decentralization based on cost-benefit analyses, specific metrics, and IT capabilities.

- IT Investment and ROI Analysis: Incorporating a framework for assessing the return on investment (ROI) for IT initiatives aimed at reducing coordination costs, which would be useful for firms considering digital transformation as part of their growth strategy.

8. Additional Sections for Clarity and Flow

- Definitions and Glossary: Adding a glossary of key terms, such as agency costs, bonding costs, decision information costs, and vertical/horizontal integration, would enhance clarity for readers less familiar with economic and management terminology.

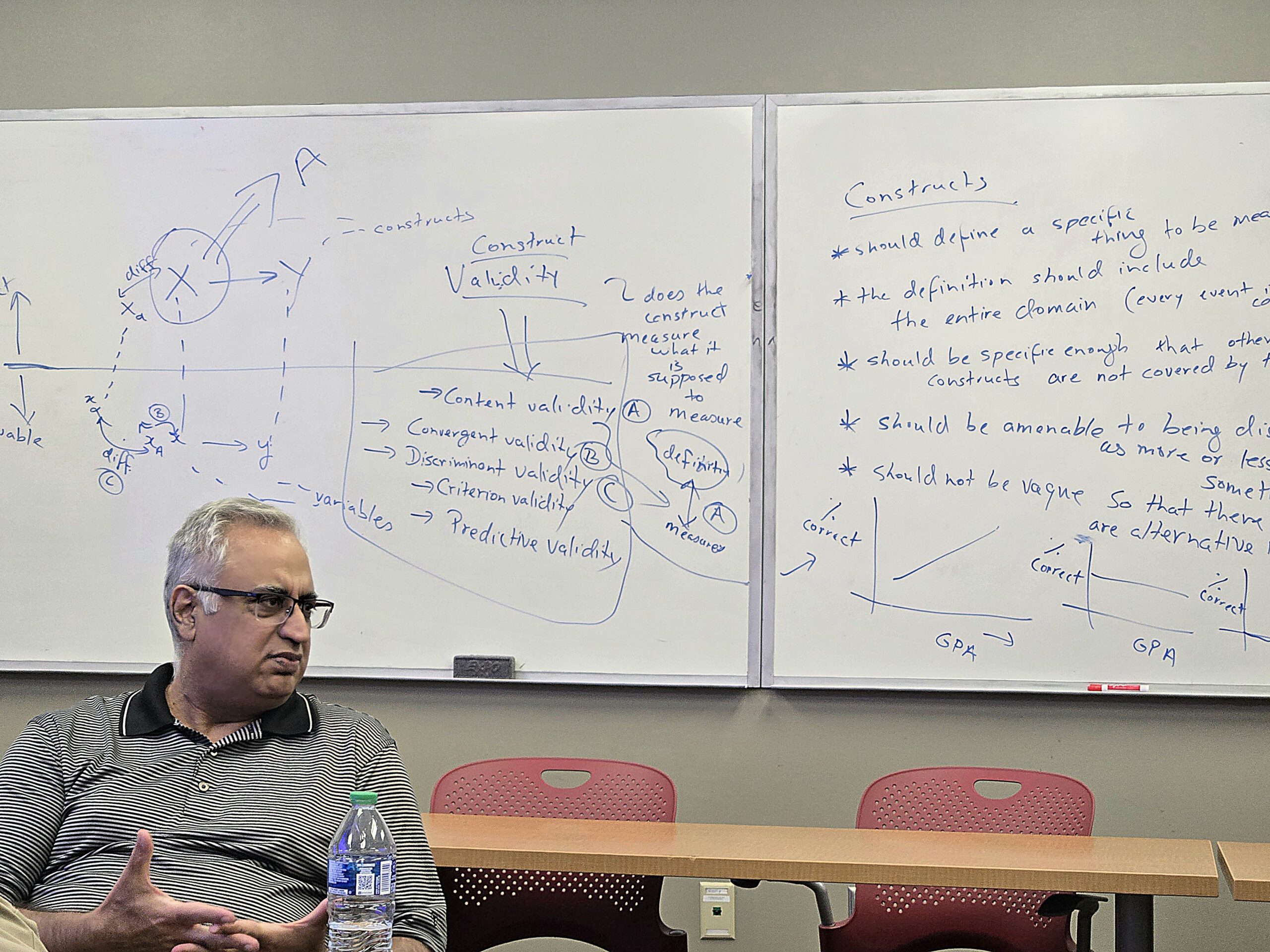

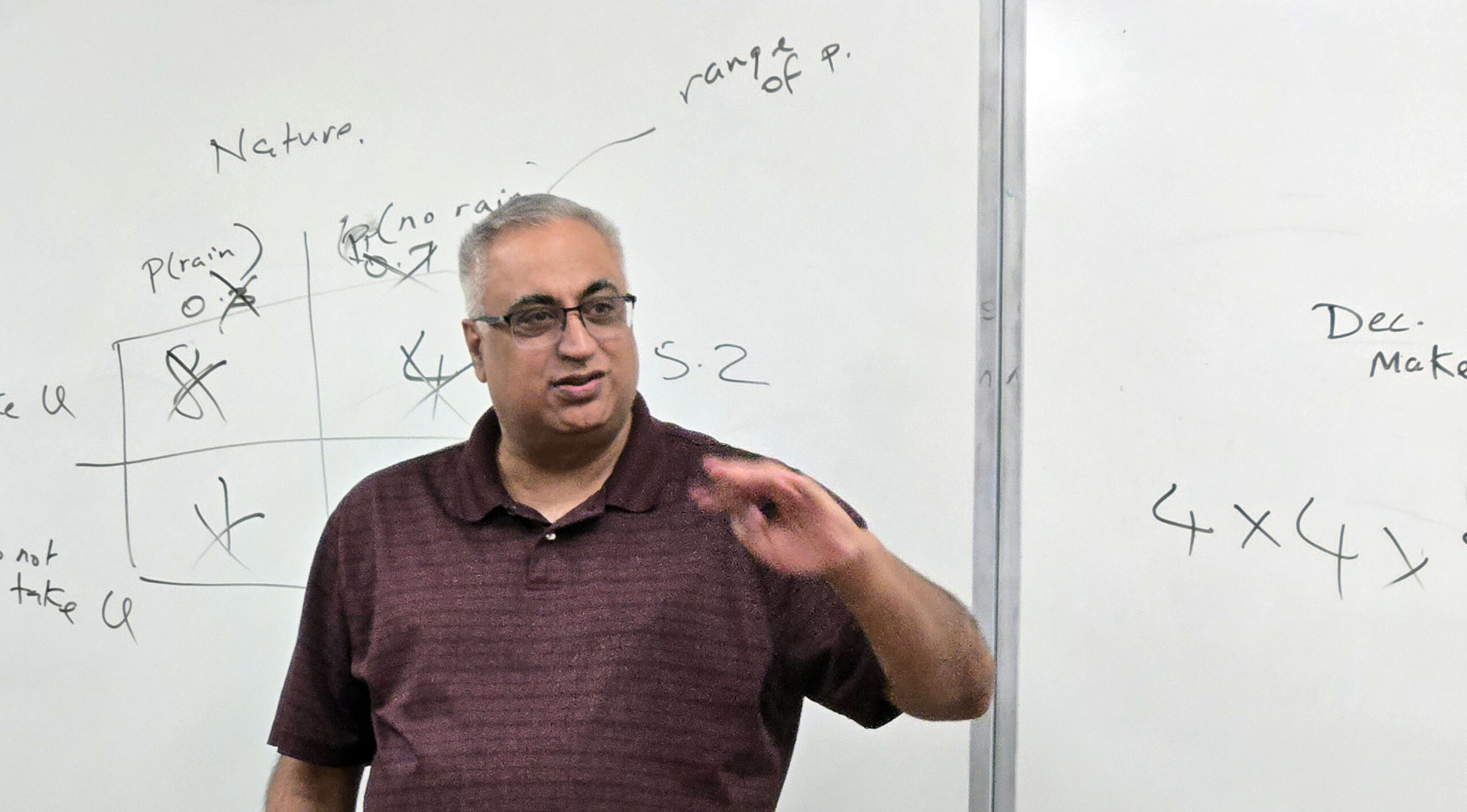

- Diagrammatic Representations: Visual aids like flowcharts, cost curves, and decision trees can clarify the relationships between agency costs, transaction costs, IT impact, and firm structure. For instance, a chart showing the trade-off between external coordination costs and internal agency costs as firm size grows could visually illustrate key points in the theory.

9. Concluding Synthesis

- Integrative Conclusion: Conclude with a synthesis that ties together the various theoretical insights, real-world applications, and future directions. Highlighting the dual role of IT as both a centralizing and decentralizing force can reiterate the core theme of the paper, leaving readers with a cohesive takeaway about the dynamic nature of firm structure in response to IT.

Leave a Reply